Clique nas imagens para ampliar

Bem vindo ao sistema de gerenciamento de ativos da Rede Industrial! Você está buscando uma solução eficiente para melhorar a gestão de manutenção da sua empresa? Então faça uma cotação conosco e descubra como podemos ajudá-lo a alcançar esse objetivo de forma ágil e eficaz.

O que é um sistema de gerenciamento de ativos?

Um sistema de gerenciamento de ativos é uma ferramenta utilizada para realizar o controle e gestão de todos os ativos de uma empresa. Isso inclui não apenas máquinas e equipamentos, mas também softwares, tecnologias e até mesmo colaboradores. Essa solução permite uma visão completa de todos os recursos utilizados pela empresa, facilitando a tomada de decisão e otimizando processos.

Funcionalidade do sistema de gerenciamento de ativos

Um sistema de gerenciamento de ativos tem como principal funcionalidade fornecer uma visão geral dos ativos da empresa. Isso inclui informações como localização, status, histórico de manutenção, custos e outros detalhes importantes para a tomada de decisão. Além disso, essa solução também permite o controle de estoque, emissão de relatórios e a programação de manutenções preventivas.

Vantagens de utilizar um sistema de gerenciamento de ativos

- Redução de custos: Ao ter uma visão completa dos ativos, é possível identificar e corrigir possíveis desperdícios, evitando gastos desnecessários.

- Maior eficiência: Com a automatização de processos, o sistema de gerenciamento de ativos permite uma gestão mais eficiente e rápida, otimizando o tempo dos colaboradores.

- Tomada de decisão estratégica: Com informações precisas e atualizadas, é possível tomar decisões mais assertivas e planejar ações futuras com base nos dados fornecidos pelo sistema.

- Maior controle e segurança: Ao centralizar todas as informações dos ativos em um único sistema, é possível ter um controle mais rigoroso e garantir a segurança dos dados.

- Melhoria no desempenho dos ativos: Com a realização de manutenções preventivas e o monitoramento constante, é possível aumentar a vida útil dos ativos e melhorar o seu desempenho.

sistema de gerenciamento de ativos na indústria

O sistema de gerenciamento de ativos é fundamental para empresas de qualquer segmento, mas se destaca principalmente na indústria. Isso porque nesse setor, os ativos são responsáveis pela produção e, portanto, qualquer falha ou quebra pode gerar grandes prejuízos. Com o uso dessa solução, é possível evitar imprevistos e manter uma operação eficiente e contínua.

Recomendações para escolher um sistema de gerenciamento de ativos

Ao optar por um sistema de gerenciamento de ativos, é importante considerar algumas recomendações para garantir a escolha da melhor solução para a sua empresa. Entre elas, estão:

- Confiabilidade e segurança do sistema;

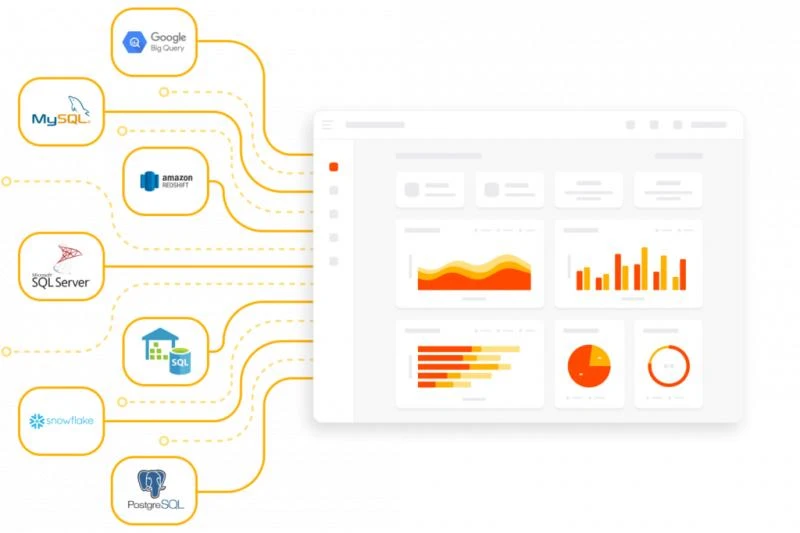

- Integração com outras ferramentas utilizadas pela empresa;

- Facilidade de uso e entendimento;

- Capacidade de expansão e atualização;

- Suporte e treinamento oferecidos pelo fornecedor da solução.

Como podemos ver, o sistema de gerenciamento de ativos é um aliado indispensável para as empresas que desejam melhorar o seu desempenho e ter uma gestão mais eficiente. Se você busca uma solução completa e confiável para a gestão de manutenção da sua empresa, entre em contato com a Rede Industrial e solicite uma cotação. Estamos prontos para ajudá-lo a alcançar seus objetivos.